Please note:

Investing in early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. This platform is targeted solely at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. Investors are encouraged to review and evaluate the investments and determine at their own discretion, the appropriateness of making the particular investment. The information on this website is provided for informational purposes only, but we cannot guarantee that the information is accurate or complete. We strongly encourage investors to complete their own due diligence with licensed professionals, prior to making any investment and will not offer any legal or tax advice.

Short Summary

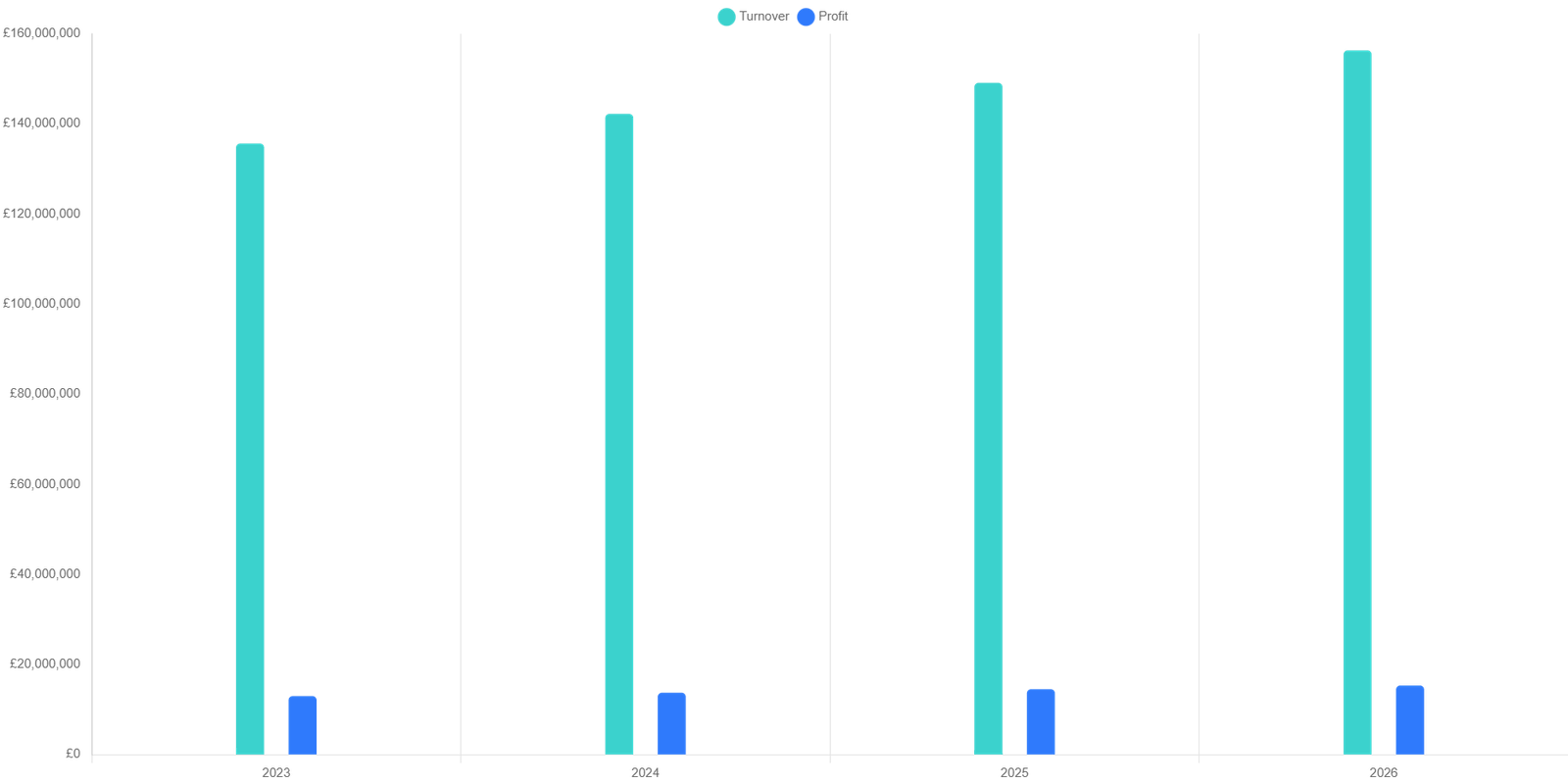

We are acquiring eight UK construction companies using a buy, build, and exit strategy. Combined turnover is £138 million with an EBITDA of £15.7 million. Each acquisition is at 3x EBITDA or below, aiming to enhance efficiency, drive growth, and exit

Highlights

- Proven track record of building a construction group (£25m turnover).

- DD is 80% of the way completed and the deals are ready to be funded.

- Current vendors staying on within the business to reduce upheaval.

- Profitable from day one post acquisition.

- Exit value has been achieved many times in this market.

Overview

| Target | 100,000,000 |

| Minimum | 90,000,000 |

| Investment Raised | 0 |

| Previous Rounds | 0 |

| Stage | Breaking Even |

| Investor Role | Any |

The Team

Our team comprises experts in M&A from diverse backgrounds, each working at the height of their profession. Our board includes leaders from the finance, construction, and M&A sectors, providing a wealth of experience and strategic insight. Key members include a head of finance with extensive investment banking experience, a construction industry veteran with a track record of successful project management, and M&A specialists renowned for their deal-making prowess. This high-calibre team ensures we have the expertise and leadership required to execute our buy, build, and exit strategy effectively and maximise returns for our investors.

Richard Brady

Strategic and financial consultant

Richard spent 22 years as a senior executive in financial services - Working for CPP Group as Managing Director for Asia Pacific Region based in Hong Kong, the UK Business Development Director for Zurich Advice Network, as AIA’s Vice President for agency in Shanghai and as the Regional Director for HSBC in the UK. He has spent a further 18 years as an entrepreneur, business investor, advisor, and non-executive director for a range of companies. He has founded, built, bought, sold, turned around and merged 22 companies across 7 countries and specialises in M&A work. Richard has been involved with companies in construction, technology, facilities management, property, finance, recruitment, and training.

Kurtis Rose

Director

With over 15 years of experience in the construction industry, Kurtis Rose is a dynamic leader with a proven track record in deal-making and scaling businesses. Having worked within Tier 1 management teams for Siemens Mobility and Network Rail, he played a critical role in driving complex infrastructure projects and negotiating multimillion-pound contracts. As the founder of CDK Group Services, Kurtis rapidly grew the business to a £25m turnover in just four years, leveraging his commercial acumen and strategic partnerships. Known for his ability to close deals, build relationships, and drive growth, Kurtis continues to deliver exceptional value in the construction and infrastructure sectors.

Colm McCrea

Group Financial Director

Colm is a business expert with over 15 years of experience across a diverse array of sectors, including financial services, oil and gas, mining and construction. Having worked with clients such as Tata Steel, Cemex and Lafarge Tarmac, Colm is now the Group Financial Director of Nexus where he plays a leading role in the group’s acquisition strategy successfully completing deals valued at £12m in the past three years. Known for his strong commercial and analytical skills, Colm is able to build a strong rapport with all stakeholders from employees to directors and investors, built on a foundation of trust and respect.

Darren Chester

Director

With a distinguished military background, including multiple tours and three years in contracting, Darren honed exceptional communication and leadership skills under high-pressure situations. His ability to streamline decision-making and align teams to achieve clear objectives has been central to his success. Darren has led seven successful deals for his own team and over 20 deals for other companies, often resolving negotiations when they became challenging. A strong advocate for collaboration, he values the strength of his network over individual deal gains. Darren’s strategic mindset and ability to ease tensions make him an invaluable asset in high-stakes negotiations.

The Deal

Looking for PKR 1,829,000,000 - Min per Investor PKR 9,100,000 We are seeking £5 million to secure £22m in vendor funding for acquisitions. This investment will be secured by a first charge over the group. In return an investor will receive a 12.5% equity stake and we anticipate an immediate 100% uplift in paper value (3x to 6x multiple). The anticipated exit value is projected at £18m. We would be willing to give away increased equity for increased capital investment. All due diligence and financials will be available in a data room for serious interested parties who are capable of completing the transaction swiftly. This investment will enable us to consolidate and grow the acquired companies, driving significant returns for our investors.