Please note:

Investing in early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. This platform is targeted solely at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. Investors are encouraged to review and evaluate the investments and determine at their own discretion, the appropriateness of making the particular investment. The information on this website is provided for informational purposes only, but we cannot guarantee that the information is accurate or complete. We strongly encourage investors to complete their own due diligence with licensed professionals, prior to making any investment and will not offer any legal or tax advice.

Short Summary

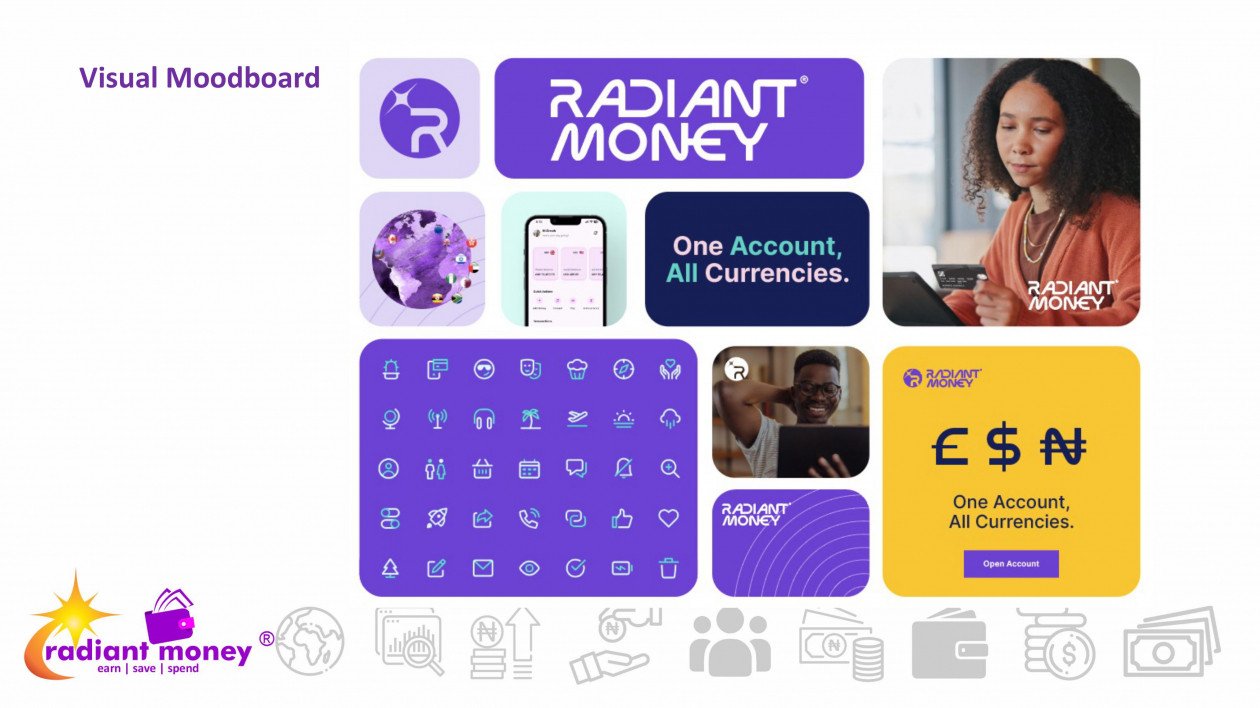

Borderless Banking Reinvented | Radiant Money is a premier digital multi-currency financial platform that empowers individuals/businesses to seamlessly open virtual accounts and conduct secure global transactions with unmatched ease & cost-efficiency

Highlights

- Partnership with Visa, Currency Cloud, Clear Bank, GBG, Iwoca & Youlend

- Daily local banking, Card Transactions in 2 currencies.

- Receive Payments from 180+ countries

- FX Conversions In 58+ currencies, convert and hold for 12 months.

- FPS, CHAPS, BACS, Swift Payments

Overview

| Target | 90,000,000 |

| Minimum | 9,000,000 |

| Investment Raised | 0 |

| Previous Rounds | 0 |

| Stage | Breaking Even |

| Investor Role | Any |

The Team

? Tayo Babatunde- Chief Executive Officer | Driving Business Excellence and Pioneering Strategic Growth Initiatives. ? Dr Jacob Abegunde- Chief Technology Officer: a well-motivated individual with great enthusiasm for teaching and the application of cutting-edge information technology to business management. ? Oladipupo Ajibona- 10 years experience in business operations and financial management in multiple industries. ? Babatunde Iwajomo-Chief Finance/ Compliance Officer: 15 years experience in Sales, Business Dev., Operations and Global supply chain mgt. ? Bukola Aghachukwu-Chief Business Analyst Officer: Expertise in the financial services and information technology industries

Tayo Babatunde

CEO

As a dedicated wife, mother of three beautiful children and an entrepreneur, I have successfully navigated the complexities of various industries, demonstrating adaptability and strategic acumen. Starting in the UK Healthcare sector, I optimized operations and ensured regulatory compliance, laying the groundwork for sustainable practices and business growth. Progressing into the Financial Services industry, my focus shifted to creating innovative strategies and fostering strong client relationships. I expertly navigated the intricacies of financial planning, asset management, and compliance, even amidst unpredictable economic scenarios. In the realm of Property Investment & Management, I strategized investments and portfolio management.

Jacob Babatunde Abegunde

Jacob Babatunde Abegunde

A well-motivated individual with great enthusiasm for teaching and the application of cutting-edge information technology to business management. I have 7 years of experience working as a system and network administrator in a commercial bank in Nigeria, 15 years of experience working as a senior network and security consultant in a University in the United Kingdom and 5 years of experience working as a senior lecturer in the same University in the United Kingdom.

Oluwabukolami Aghachukwu

Chief Business Analyst Officer

Strategic and results-oriented Senior IT Business Analyst with diverse expertise in the financial services and information technology industries, including fintech, banking operations, core banking software deployment, data migration, project management, client relations, and business transformation

The Deal

Looking for PKR 914,000,000 - Min per Investor PKR 9,100,000 We are seeking to raise a £2.5 million seed round, providing a financial runway of 24 months. The funding round is expected to have a financial runway of 24 months Use of Funds * Operational Expenses: 20% * Partnership Development: 10% * Technology Dev. & Fixed costs: 40% * Marketing & Customer Acquisition: 30%